The Rise of Automated Trading in Crypto: A Deep Dive into Sniper Bots,…

페이지 정보

작성자 Regena Marino 작성일 24-10-16 18:46 조회 2 댓글 0본문

This incentivizes miners to prioritize their transactions, ensuring they can front-run or sandwich other trades. Gas Optimization: To ensure their transaction is included in the block before others, MEV bots often bid higher gas fees.

This is done by placing a buy order before a large transaction and a sell order immediately after it, profiting from the price increase caused by the large trade. The Sandwich Bot is an advanced trading bot that capitalizes on the concept of "sandwiching" transactions between two other trades.

MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, or censoring transactions within a block. This phenomenon has given rise to MEV bots, sniper bot crypto bot solana which are sophisticated tools used to exploit these opportunities and generate significant profits. In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic.

In decentralized trading, front-running refers to the practice of executing a trade in advance of a large transaction, anticipating that the big order will move the price in a favorable direction. This is especially common in DeFi, liquidity sandwich bot where large buy or sell orders (often from whale investors) can drastically shift market prices.

Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability. Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand.

Types of MEV Strategies

Front-Running: This occurs when a bot detects a large transaction and places its order first to profit from the resulting price movement. For instance, if a bot sees a large buy order for a token, it can buy the token first, sell it at a higher price, and pocket the difference.

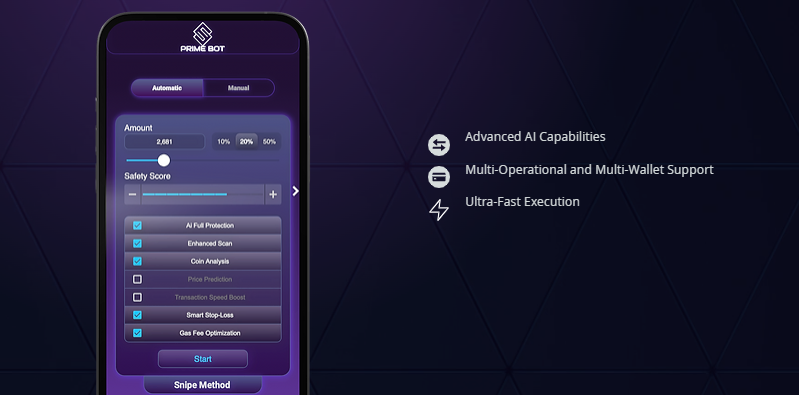

These automated tools are designed to execute trades at lightning-fast speeds, allowing users to capitalize on new token listings, liquidity additions, and other market events. In the fast-paced world of decentralized finance (DeFi), where opportunities can arise and disappear in a blink of an eye, the ability to act swiftly and decisively can be the difference between a substantial profit and a missed chance. This is where sniping bots come into play.

By executing trades ahead of large transactions, these bots can create short-term volatility, misleading other traders and making price prediction more difficult. Market Manipulation

Front-running bots contribute to artificial price movements, which can destabilize markets.

They could then sell the tokens after the large buy order is executed, pocketing the profit from the price increase. For example, if a miner sees a large buy order for a token in the mempool (a pool of pending transactions), they might place their own buy order before the large trade is processed, driving up the price.

This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, where tokens are launched on decentralized platforms like Uniswap, PancakeSwap, or SushiSwap. Due to the nature of these events, token prices can fluctuate significantly in seconds, making sniper bots highly valuable for those looking to buy in at the lowest possible price or capture short-term price movements.

Executing the Trade: Once the opportunity is detected, the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

These bots monitor the mempool in real-time and execute transactions that can capture MEV by front-running, back-running, best sniper bot crypto or conducting sandwich attacks on other traders' transactions. By automating this process, MEV bots can operate at a speed far beyond human capability, bot sniper bot crypto crypto giving their operators an advantage in capturing arbitrage or price discrepancies. MEV Bots: Automating the Process

MEV bots are automated programs designed to detect and exploit these opportunities.

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g., the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

Profit-Taking Mechanism: Many DeFi best crypto sniper bot bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin. This feature helps traders lock in profits without constantly monitoring the market.

Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies. Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets.

This is done by placing a buy order before a large transaction and a sell order immediately after it, profiting from the price increase caused by the large trade. The Sandwich Bot is an advanced trading bot that capitalizes on the concept of "sandwiching" transactions between two other trades.

MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, or censoring transactions within a block. This phenomenon has given rise to MEV bots, sniper bot crypto bot solana which are sophisticated tools used to exploit these opportunities and generate significant profits. In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic.

In decentralized trading, front-running refers to the practice of executing a trade in advance of a large transaction, anticipating that the big order will move the price in a favorable direction. This is especially common in DeFi, liquidity sandwich bot where large buy or sell orders (often from whale investors) can drastically shift market prices.

Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability. Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand.

Types of MEV Strategies

Front-Running: This occurs when a bot detects a large transaction and places its order first to profit from the resulting price movement. For instance, if a bot sees a large buy order for a token, it can buy the token first, sell it at a higher price, and pocket the difference.

These automated tools are designed to execute trades at lightning-fast speeds, allowing users to capitalize on new token listings, liquidity additions, and other market events. In the fast-paced world of decentralized finance (DeFi), where opportunities can arise and disappear in a blink of an eye, the ability to act swiftly and decisively can be the difference between a substantial profit and a missed chance. This is where sniping bots come into play.

By executing trades ahead of large transactions, these bots can create short-term volatility, misleading other traders and making price prediction more difficult. Market Manipulation

Front-running bots contribute to artificial price movements, which can destabilize markets.

They could then sell the tokens after the large buy order is executed, pocketing the profit from the price increase. For example, if a miner sees a large buy order for a token in the mempool (a pool of pending transactions), they might place their own buy order before the large trade is processed, driving up the price.

This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, where tokens are launched on decentralized platforms like Uniswap, PancakeSwap, or SushiSwap. Due to the nature of these events, token prices can fluctuate significantly in seconds, making sniper bots highly valuable for those looking to buy in at the lowest possible price or capture short-term price movements.

Executing the Trade: Once the opportunity is detected, the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

These bots monitor the mempool in real-time and execute transactions that can capture MEV by front-running, back-running, best sniper bot crypto or conducting sandwich attacks on other traders' transactions. By automating this process, MEV bots can operate at a speed far beyond human capability, bot sniper bot crypto crypto giving their operators an advantage in capturing arbitrage or price discrepancies. MEV Bots: Automating the Process

MEV bots are automated programs designed to detect and exploit these opportunities.

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g., the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

Profit-Taking Mechanism: Many DeFi best crypto sniper bot bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin. This feature helps traders lock in profits without constantly monitoring the market.

Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies. Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets.

- 이전글 Mostbet: Az online kaszinózás új szintje Magyarországon

- 다음글 What You Must Forget About Making Improvements To Your Toto Korea

댓글목록 0

등록된 댓글이 없습니다.